Investing in small-cap mutual funds has become increasingly popular among retail investors seeking high returns over the long term. Among the array of options available in the Indian mutual fund landscape, mutf_in: sbi_smal_cap_my8974, commonly referred to as SBI Small Cap Fund, stands out as a favored choice. This fund, managed by SBI Mutual Fund, has gained attention for its impressive performance and potential to deliver substantial returns in the long run, albeit with some inherent risks. In this article, we will delve into what the mutf_in: sbi_smal_cap_my8974 entails, its investment strategy, its risk-reward profile, and why it could be a key component in a well-diversified investment portfolio.

What is mutf_in: sbi_smal_cap_my8974?

mutf_in: sbi_smal_cap_my8974, or the SBI Small Cap Fund, is a small-cap mutual fund launched by SBI Mutual Fund. This mutual fund invests primarily in companies that fall under the small-cap category, typically firms with a market capitalization of less than ₹5,000 crore. Small-cap funds are known for their high-growth potential but are equally notorious for their volatility, making them suitable for investors with a high risk appetite and a long investment horizon.

The main objective of mutf_in: sbi_smal_cap_my8974 is to provide investors with the opportunity for long-term capital appreciation by investing predominantly in equity and equity-related instruments of small-cap companies. Over the years, the fund has garnered a reputation for being one of the best-performing small-cap funds in India, consistently outperforming its benchmark.

Why Invest in Small-Cap Funds?

Before diving into the specifics of mutf_in: sbi_smal_cap_my8974, it’s important to understand the appeal of small-cap mutual funds. Small-cap companies typically represent the younger, growing segment of the market, often emerging as future mid-cap or large-cap giants. Because they are in the early stages of development, small-cap stocks are considered to be high-growth opportunities, especially when economic conditions are favorable.

Investing in small-cap funds can yield higher returns compared to large-cap and mid-cap funds, especially during bullish market phases. However, they also carry higher risks, including increased market volatility and lower liquidity. For this reason, small-cap funds like mutf_in: sbi_smal_cap_my8974 are more suited for aggressive investors who can handle sharp market movements and are willing to invest for the long term, typically 5 to 7 years or more.

Investment Strategy of mutf_in: sbi_smal_cap_my8974

The mutf_in: sbi_smal_cap_my8974 follows a bottom-up stock-picking approach, which means the fund manager primarily focuses on selecting individual stocks based on their intrinsic strengths rather than top-down macroeconomic factors. This investment strategy allows the fund to focus on identifying undervalued small-cap companies with the potential for rapid growth.

One of the key factors contributing to the success of mutf_in: sbi_smal_cap_my8974 is its fund management team. Managed by skilled fund managers with deep expertise in identifying small-cap companies, the fund consistently seeks out firms with strong fundamentals, sustainable business models, and growth potential. The fund does not shy away from taking concentrated bets on a select few companies, which, if successful, can lead to substantial outperformance compared to broader market indices.

In addition to focusing on high-growth small-cap companies, mutf_in: sbi_smal_cap_my8974 also looks for firms with solid financials, including strong balance sheets, low debt levels, and consistent cash flow generation. This strategy helps mitigate some of the risks associated with investing in smaller, more volatile companies.

Performance of mutf_in: sbi_smal_cap_my8974

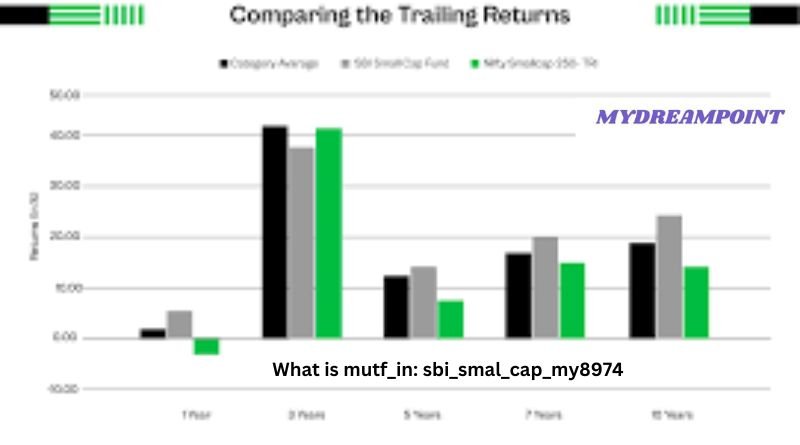

Over the years, mutf_in: sbi_smal_cap_my8974 has established itself as one of the top-performing small-cap funds in the Indian mutual fund industry. It has consistently delivered impressive returns, often outperforming its benchmark, the Nifty Smallcap 100 Index, and other comparable small-cap funds.

For instance, in the past 5 to 10 years, the fund has delivered strong double-digit annualized returns, making it an attractive option for long-term investors. However, it’s important to note that the fund’s performance can be cyclical, as small-cap stocks tend to experience higher volatility compared to their large-cap and mid-cap counterparts. During periods of market downturns or economic uncertainty, the fund may experience sharp declines in its Net Asset Value (NAV), which can be unsettling for short-term investors.

Despite the volatility, mutf_in: sbi_smal_cap_my8974 has proven to be a resilient performer over the long term, benefiting investors who are patient and have the ability to ride out market fluctuations.

Risk Factors

As with any investment in small-cap funds, mutf_in: sbi_smal_cap_my8974 comes with its share of risks. Small-cap stocks are typically more volatile than large-cap or mid-cap stocks, meaning they can experience sharp price swings in response to market conditions, economic changes, or company-specific news.

Liquidity risk is another concern for investors in small-cap funds. Since small-cap companies often have lower trading volumes than larger companies, buying or selling large quantities of stock can impact their prices, making it harder to enter or exit positions without affecting the overall performance of the portfolio.

Furthermore, small-cap funds like mutf_in: sbi_smal_cap_my8974 are susceptible to greater market corrections, which can lead to significant capital erosion in the short term. Hence, investors should be prepared for higher volatility and be willing to stay invested for longer periods to fully benefit from the potential growth.

Who Should Invest in mutf_in: sbi_smal_cap_my8974?

The mutf_in: sbi_smal_cap_my8974 is best suited for investors with a high risk appetite who are seeking long-term capital appreciation. Given the inherent volatility of small-cap funds, investors must have the patience to withstand market downturns and remain invested for the long term, typically over 5 to 7 years.

Additionally, mutf_in: sbi_smal_cap_my8974 can serve as an excellent diversification tool in a well-rounded investment portfolio. Small-cap funds tend to perform differently from large-cap and mid-cap funds, which means they can help balance overall portfolio risk. By adding small-cap funds to a portfolio that already contains large-cap and mid-cap funds, investors can benefit from potential high-growth opportunities while still maintaining exposure to more stable, established companies.

Taxation and Other Considerations

Investors in mutf_in: sbi_smal_cap_my8974 should also consider the tax implications of investing in small-cap mutual funds. Since the fund primarily invests in equities, the tax treatment follows that of equity mutual funds. If an investor holds the fund for less than one year, any gains realized are taxed as short-term capital gains (STCG) at a rate of 15%. If the fund is held for more than one year, the gains are treated as long-term capital gains (LTCG) and are taxed at 10% for gains exceeding ₹1 lakh in a financial year.

Moreover, it’s crucial to remember that small-cap funds may not be suitable for all investors. Conservative investors, those nearing retirement, or those with short-term financial goals may want to consider less volatile investment options, such as large-cap funds or fixed-income instruments.

Conclusion

mutf_in: sbi_smal_cap_my8974 or the SBI Small Cap Fund, is a high-potential small-cap mutual fund that has proven to be a top performer in the Indian mutual fund industry. With a focus on investing in small-cap companies with high growth potential, the fund offers investors the opportunity to earn substantial returns over the long term. However, given the high level of risk and volatility associated with small-cap funds, it’s best suited for aggressive investors with a long-term investment horizon.

For investors willing to take on more risk in exchange for potentially higher returns, mutf_in: sbi_smal_cap_my8974 can be an excellent addition to a well-diversified portfolio. However, investors must remain patient, stay committed for the long term, and be prepared for short-term volatility along the way.

Read also: check